Gomyfinance: Budgeting & Investing Tips You Need Now!

Are you tired of feeling overwhelmed by your finances? Take control of your money and unlock a more secure future by understanding the power of smart budgeting and strategic investing.

The world of personal finance can often feel like navigating a dense jungle. Between managing debt, tracking expenses, and making smart investment choices, it's easy to get lost. However, with the right tools and a clear understanding of fundamental principles, achieving financial freedom is not only possible, but also surprisingly attainable. This article delves into the core aspects of personal finance, offering actionable insights to help you build a solid financial foundation.

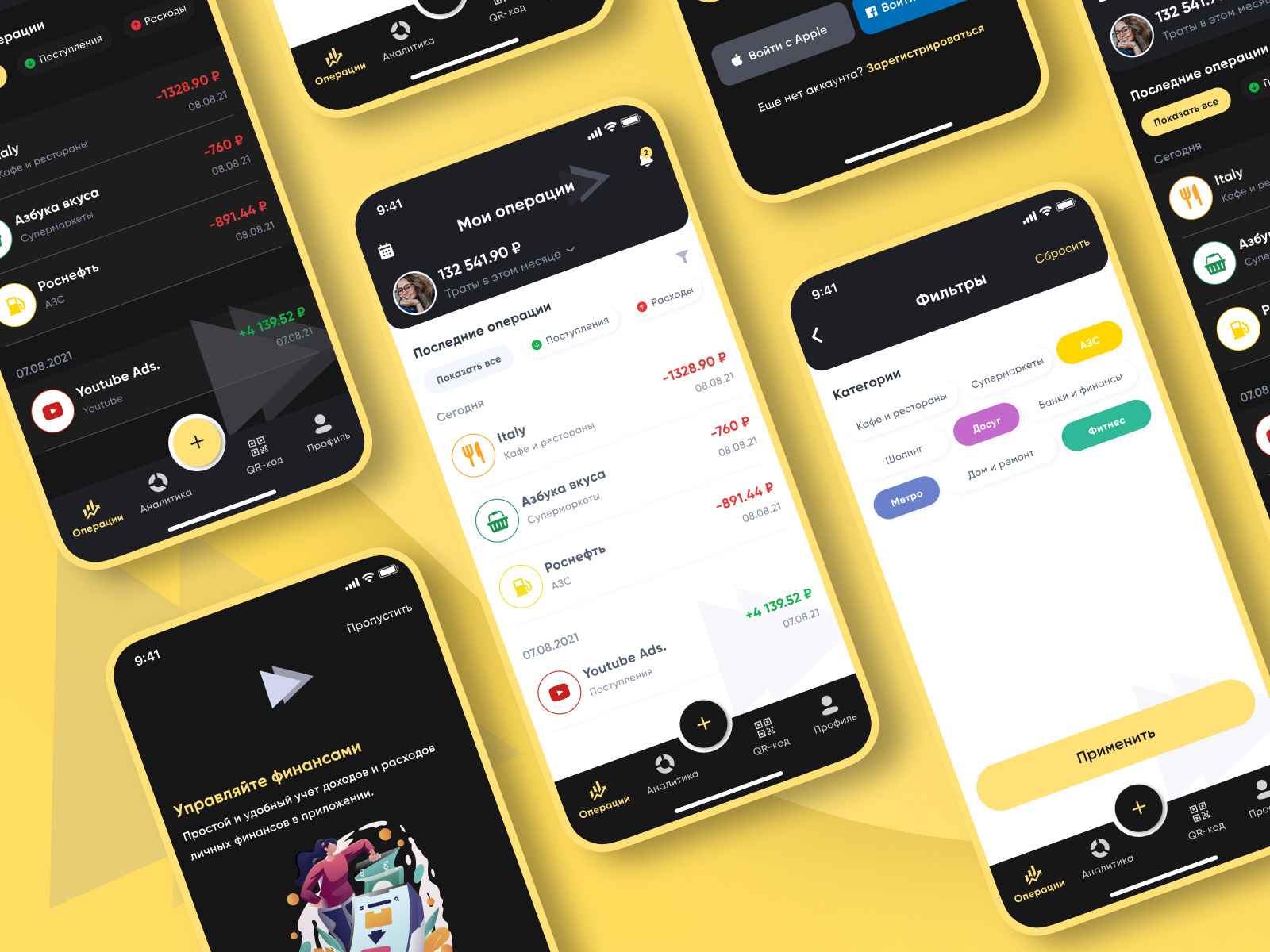

The core of sound financial management begins with a clear understanding of where your money is going. Expense tracking is no longer a cumbersome chore, thanks to a plethora of user-friendly tools and resources available. Platforms like gomyfinance.com, for example, offer intuitive interfaces that connect directly to your bank accounts and credit cards. This seamless integration allows for automatic tracking of income and expenses, eliminating the need for manual data entry and the potential for human error.

Consider a scenario. Sarah, a recent college graduate, was constantly struggling to make ends meet. She felt like her money was disappearing into a black hole, with no clear understanding of where it was going. Upon discovering gomyfinance.com, Sarah began to track her spending. The platform's visual graphs and charts immediately revealed her spending patterns. She was shocked to see how much she was spending on eating out and impulse purchases. This realization served as a wake-up call. Armed with this knowledge, Sarah started making small but significant changes. She began packing her lunch, cooking more meals at home, and consciously avoiding unnecessary expenses. Over time, these seemingly minor adjustments added up to substantial savings, enabling her to pay down her student loans and build an emergency fund.

The power of expense tracking extends far beyond simply monitoring where your money goes. It allows you to identify areas where you can cut back, freeing up funds for more important financial goals. Perhaps you're aiming to pay off high-interest debt, such as credit card balances or personal loans. By making even slightly above the minimum payments, you can drastically cut the total interest you will ultimately pay over the life of the loan and accelerate your debt repayment. Or maybe youre dreaming of a down payment on a home or a relaxing vacation. With a clear understanding of your spending habits, you can make informed decisions about how to allocate your resources to achieve these objectives. The automated tools found in modern financial platforms like gomyfinance.com streamline the process, taking the friction out of managing your cash flow.

Beyond expense tracking, budgeting forms the cornerstone of effective financial planning. Budgeting provides a roadmap, guiding your financial decisions and helping you prioritize your spending. It involves creating a plan for how you will spend your money each month, allocating funds to essential categories like housing, food, transportation, and utilities, while also allowing for discretionary spending on entertainment and leisure activities. The key to a successful budget is not just creating it but also sticking to it. Regularly reviewing and adjusting your budget based on your spending patterns and financial goals is essential.

If you're new to budgeting and seeking a straightforward, free tool to get started, gomyfinance.com may be an ideal starting point. For those who are serious about financial planning and want to learn more about budgeting, while having access to more advanced tools and resources, gomyfinance.org offers a comprehensive suite of features. Ultimately, the choice between these two platforms depends on your individual needs and financial aspirations. Both platforms offer the tools to help users take control of their finances, save efficiently, and achieve their goals.

The world of investing can seem daunting, especially for beginners. However, with the right approach, investing can be a powerful tool for building wealth and achieving long-term financial security. Gomyfinance invest is an innovative platform designed to simplify investing, making it accessible for both new and experienced investors. The platform offers intuitive tools, expert insights, and a streamlined approach to investing.

One of the most crucial aspects of investing is diversification. Diversification involves spreading your investments across different asset classes, sectors, and geographic regions to reduce risk. This means not putting all your eggs in one basket. One popular way to diversify is through the use of Exchange-Traded Funds (ETFs). Looking to expand your investment portfolio with ETFs? Learn how to invest in ETFs effectively and maximize your returns with this helpful guide. ETFs are baskets of stocks that track a specific index, sector, or investment strategy. They offer instant diversification, allowing you to invest in a wide range of assets with a single purchase. The funds sector allocations, as tracked, are led by financials (30.76%), utilities (16.47%), and communication (11.09%).

For those seeking to build a solid savings plan, gomyfinance.com saving money provides an excellent tool for setting savings goals. It lets you easily decide how much money you want to save and tracks your progress. For example, if you need $5,000 in one year, gomyfinance.com will suggest saving $416.67 monthly. Consider this as a guiding principle: making even slightly above the minimum payments can drastically cut the total interest you will ultimately pay over the life of the loan and get you out of debt faster. The platform provides the tools and resources needed to take control of your finances, save efficiently, and achieve your goals. By utilizing the platforms featuressuch as budgeting tools, savings calculators, and educational resourcesyou can develop better money habits and work toward a more secure financial future.

The automated tools and immediate notifications offered by platforms like gomyfinance.com play a crucial role in effective money management. These features keep you informed about approaching spending limits and unusual transactions. This proactive approach can help you avoid overspending and catch fraudulent activity early on, minimizing potential financial setbacks. This includes features like automated alerts and notifications that can warn you about approaching limits or unusual transactions.

Depositing a check for someone else might seem like a simple favor, but there are important banking rules and potential risks to consider. Understanding these rules is paramount in safeguarding yourself and others. While the act might appear innocent, depositing a check for someone else can expose you to potential risks, including legal ramifications and financial losses. It is crucial to be aware of these risks before offering this type of assistance.

Here's a breakdown of some popular budgeting and expense tracking tools to aid in your financial journey:

- A free tool that connects to your bank accounts and credit cards to automatically track your income and expenses.

- Platforms like gomyfinance.com saving money provide the tools and resources needed to take control of your finances, save efficiently, and achieve your goals.

- Gomyfinance.com create budget's expense tracking shows how small changes add up to big savings.

Remember, the path to financial freedom is not a race; its a marathon. It requires consistent effort, discipline, and a willingness to learn and adapt. By embracing the principles of smart budgeting, strategic saving, and informed investing, you can pave the way for a more secure and fulfilling financial future. Start today, and watch your financial goals transform into reality.